If you’ve ever looked into carbon offsetting, you’ve probably heard of additionality. It’s a concept that can easily confuse you but it’s actually pretty simple, and we’ll do our best to explain it in layman’s terms, unlike many of the other explanations out there!

Understanding carbon offsetting

First things first, we need to understand how carbon offsetting works. You can find a deeper explanation of carbon offsetting and its pros and cons here, but a summary is:

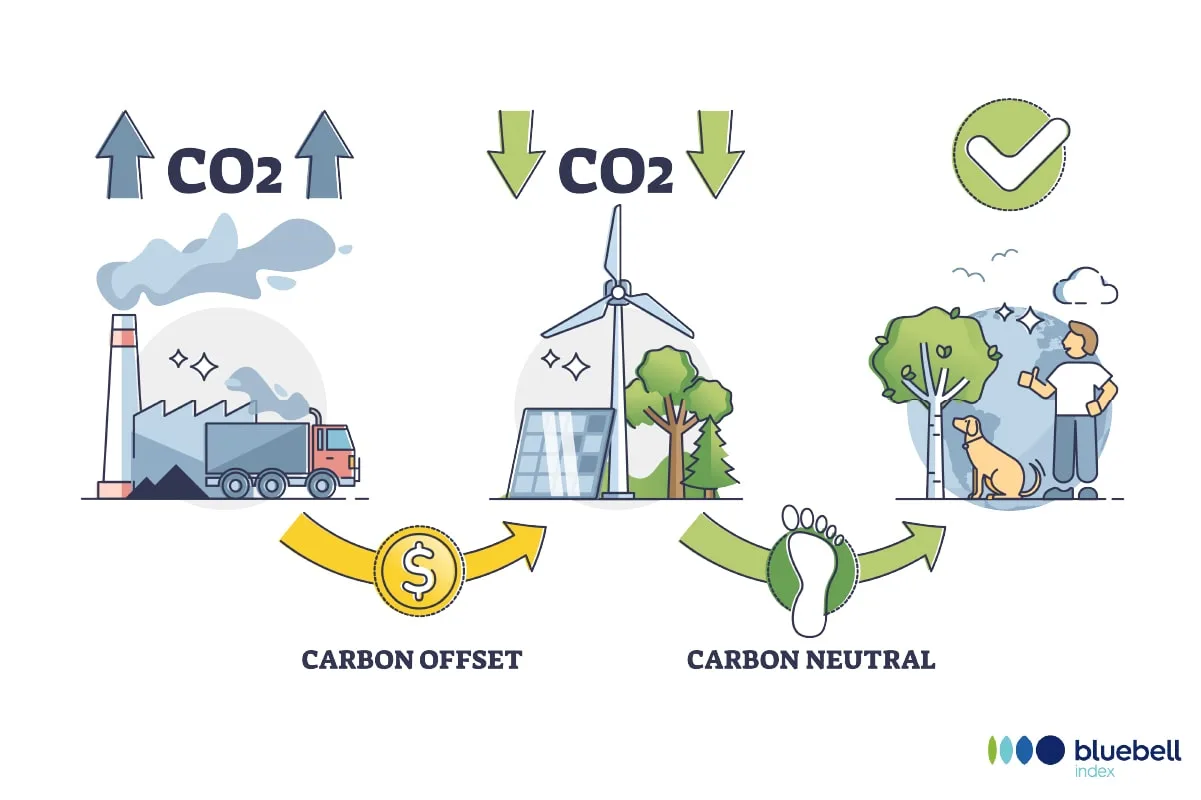

Carbon offsetting is generally a voluntary action. It involves two parties: the emissions emitter and the emissions remover. Carbon offsets are desired by companies that produce emissions and want to compensate for them by removing them from the atmosphere, which emissions-removers can do. Carbon offsets are issued by organizations with operations in carbon removal, such as tree planting, renewable energy investments, and carbon capture (remember this for later, as this is where the problem lies). Once they work together, the goal is that the amount of emissions produced by that company is balanced out.

This is a simplified process of how carbon offsetting works:

- A company does everything it can to reduce emissions from its business model.

- Only then does a company enter the voluntary carbon market. Corporate emissions are calculated by an offset provider.

- Emissions of carbon-emitting companies can be offset by the purchase of carbon offsets which are issued by organizations that pull CO2 emissions from the air.

- Carbon-neutral certifications can be provided to the purchasers for assurance of their legitimacy.

The meaning of additionality

Now, coming back to the part I told you to remember – the organizations or projects involved in carbon removal. The problem is that a lot of the time, these projects and organizations would have existed anyway. Meaning that regardless of whether carbon offsetting existed, these projects would have gone ahead. The carbon removal in question is happening for reasons that have nothing to do with the concept of carbon offsetting.

Yet, companies claim to be carbon-neutral by funding these projects. They gain an image of having produced lower carbon emissions when, in reality, they continue to add emissions into the atmosphere.

Take, for example:

- GHG-reducing activities that are required by law

- energy-saving investments that are profitable without the sale of any carbon offsets

- or emission-reducing projects that simply have other funding streams such as governmental or charitable grants.

Starting to make sense?

A carbon offsetting project is additional if that project would not have existed without the sale of carbon offsets by the project owner. I.e. the carbon removal project only exists because a company wants to compensate for its emissions. The project is created with a prospect for the project owner to sell carbon offsets. This is additionality.

Non-additional carbon offsetting can include projects that would’ve existed anyway without the selling of any carbon offsets or projects that happened in the past, now being bought for carbon offset credits.

So if you ask us here at Akepa, every carbon offsetting project needs to be additional in order for it to be impactful. Otherwise, the likelihood that any non-additional carbon offsetting project is instead increasing carbon emissions is very high. In other words, if your carbon offsetting project is not additional, then purchasing carbon offset credits to claim that you are reducing your emissions is like paying to make climate change worse.

And that’s proven to be true in many cases.

Can carbon offsetting be impactful without additionality?

In a study of 1,350 wind farms across India, 52% of renewable energy projects weren’t reliant on the sale of carbon offset credits and would have very likely been built anyway, estimating that “the sale of these offsets to regulated polluters has substantially increased global carbon dioxide emissions.”

A data analysis by Climate Home News showed that “junk” or “zombie” offsets are being used to meet climate targets, from projects whose past emission reductions can still be bought despite many being over 10 years old. Most of these projects are further associated with human rights violations and failure to deliver promised climate benefits.

Without additionality, any positive impact from carbon offsetting isn’t guaranteed.

The solution to carbon offsetting

It’s no surprise that in 2024, the value of the carbon offsets market had dropped by 61% since 2022. Carbon offsets just aren’t as reliable as we once thought they were, with the flimsiness corroborated by a rising number of studies. This is why the quality and integrity of offsets are being widely debated, with one key component of high-quality offsets being additionality. In its absence, carbon offsetting frankly isn’t worth much. Or worse, it can be a net loss.

But one major problem is that additionality can be difficult to measure. Its determination is subjective. Even as carbon offsetting programs work to regulate the quality of offsets more strictly, additionality is tricky to empirically measure. There are approaches, but they come with their strengths and weaknesses. For carbon offset buyers, there are guidelines that can help assess the additionality of projects.

Besides additionality, other factors determine the quality of a carbon offset project, and this guide offers a digestible yet deep understanding of them, plus how you can assess these criteria before supporting a project.

Finding the right balance

So, we hope we’ve helped to explain the meaning of a term that’s being used more often. But regardless of how additional a project is, offsetting should certainly be combined with an approach to emissions reduction – as we explore in this interview with ClimatePartner. Offsetting can be additional (aka useful) but it’s far better to reduce emissions in the first place.

And perhaps the best approaches to solving the climate crisis involve deeper system change, an idea that we start to develop in this Venn diagram infographic on finding the best solutions to climate change.

Leave a Reply