ESG (Environmental, Social, and Governance), sustainability, and impact investing are often used as if they are carbon copies, but each holds a distinct meaning in terms of sustainable investment. Understanding the differences is (or should be) a high priority for sustainable-minded investors, or businesses alike, as you navigate sustainable finance and societal pessimism like the “anti-ESG” movement.

Yes, folks. There’s an anti- for everything nowadays. Some movements are legit about being open-minded as much as it’s about speaking the truth (aka telling establishments to bog off).

But, and I write this cautiously, sometimes the anti- turns progress around for the worst. Loosely defined beliefs aimed at fighting a perceived shift towards so-called “woke” ideas in society, and in this case sustainable business, now cause executives to keep their heads low (aka “greenhushing”).

This article looks at some quick definitions to understand the overlap of these terms and addresses the murkiness of sustainable business with some well-needed optimism.

ESG vs. sustainability vs. impact investing

While these terms share common goals, such as addressing societal challenges and promoting responsible business practices, they function at different levels.

Quick definitions

- Sustainability broadly refers to the maintenance of something continuously over time.

- ESG involves a set of standards for evaluating a company’s ethical impact to help conscious stakeholders screen potential investments.

- Impact investing is about investing in projects that aim to do good while also expecting strong investment returns.

Demystifying ESG and sustainability

ESG factors indicate a company’s sustainability performance, considering economic aspects and the long-term interplay between environmental, social, and economic factors.

Martin Kremenstein, head of retirement and ETF solutions at Nuveen, explains in the video below how ESG metrics serve as a quality indicator and a risk management tool.

Martin says, “What you’re really looking at is another way of assessing a company, without looking at its balance sheet, and looking at how it impacts the broader society at large.

Sustainability goes beyond a specific list of criteria and often includes:

- Adopting sustainable business practices

- Inventing sustainable development

- Reducing carbon emissions

- Promoting renewable energy

- Establishing fair labour conditions

- Supporting local communities

- And so on

These initiatives have become essential in business today, especially in the face of climate change and the increased recognition of sustainability.

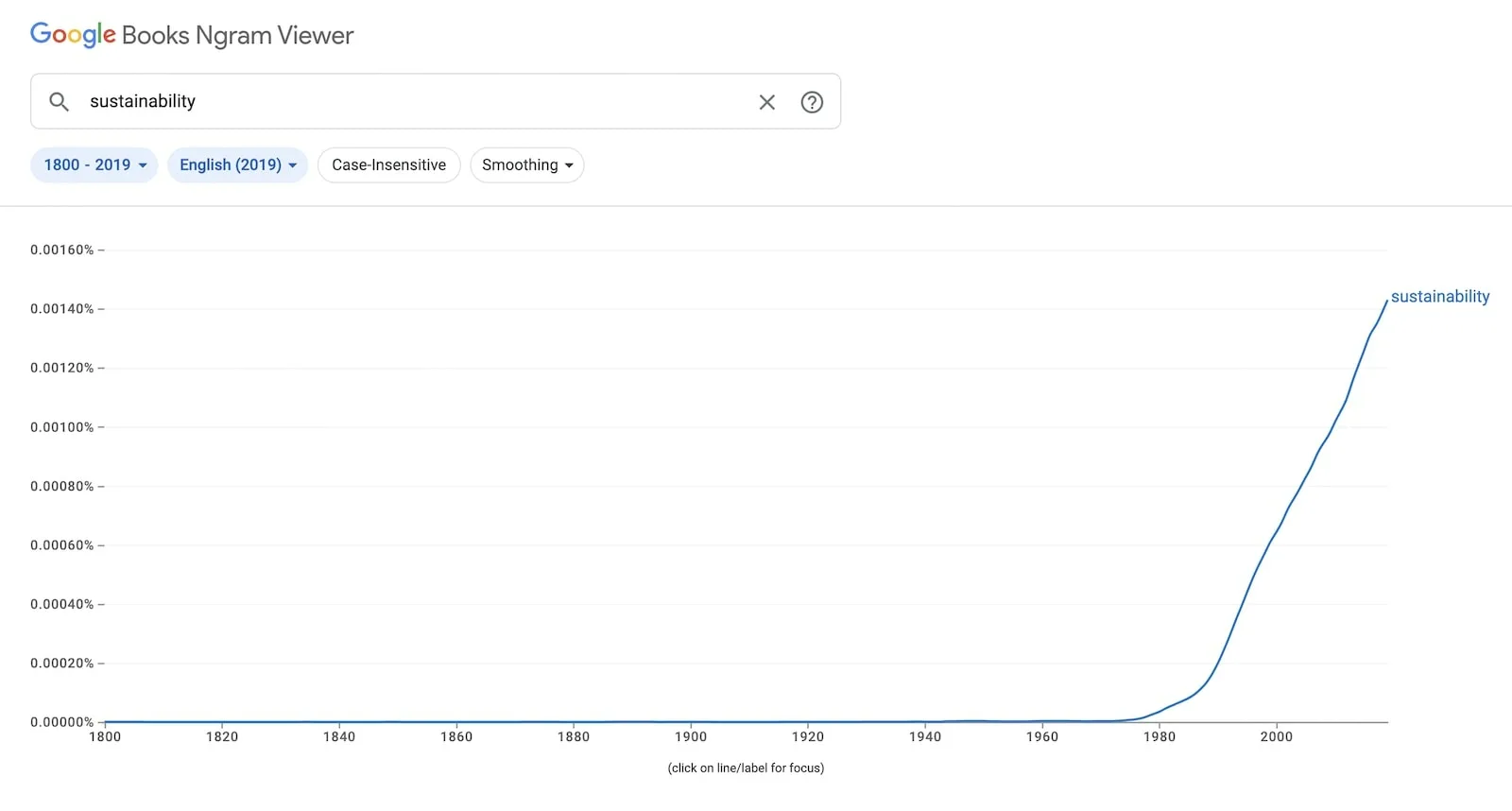

An interesting observation is that before the internet and social media, awareness around sustainability was few and far between. According to Google Ngram, interest only grew exponentially around the official birth of the Internet in 1983 when all networks could be connected by a universal language.

Doing good while achieving sustainable returns – example:

Think about carpet tiles for a minute.

Folks didn’t know about the environmental and health impacts of carpet materials. But with information now easily accessible and shareable online, folks are more aware. As such, businesses feel the mounting pressure to be more transparent in their effort to inform people and adopt sustainable business practices.

In this case, the carpet industry sees the urgency to change largely in response to consumer demands like installation trends shifting away from large traditional rolls towards modular products. And various initiatives, such as the Green Label Plus™ program removed certain chemicals from the manufacturing process. Plus, increasing concerns about sustainability pushed for carpet recycling and using more eco-friendly materials.

Today, the global market leader in carpet tiles, Interface is a notable example of doing good while achieving high returns. Its “Mission Zero” strategy reached $438 million savings in cumulative avoided-waste costs with sales reaching over $1 billion. A further 82 percent cut in greenhouse gas emissions and 60 percent reduction in fossil fuel consumption (Eco Measures Report, 2010, Green Mountain Sustainability Report, 2010).

In the video below, Interface’s VP and chief sustainability officer Erin Meezan talks about how nature can teach folks to make business more sustainable.

The murkiness of sustainable investing

To some, the discourse surrounding ‘sustainability’ is all too confined. And the ubiquity of the term, usually prefaced by ‘environmental’, ‘environmentally’ and ‘ecological’, leads to disputes over what is to be sustained, for whom, by whom, and how to achieve this universal call to action aimed to transform our world.

The hype in metrics also raises an elephant-in-the-room question: What are the specific financial and social virtues of the scores designed to assess the financial risks associated with a company’s ESG practices and are investors growing sceptical of it all?

It sure is a sticky situation.

It’s easy to define these terms in text. But in reality, they are continuously changing with the happenings around the world. In a 2021 International Survey of Asset Managers, the Index Industry Association said,

“ESG itself is a moving target, constantly shifting in the light of changing societal attitudes, technology and the scientific understanding of risk.”

There are no definitive definitions because beliefs and perceptions about what’s right and important vary across cultures and societies. They even differ among demographics and within industries.

As Hortense Bioy, the global director of sustainability research at Morningstar said,

“ESG means different things to different people. I’m not sure we can come to an agreement about what is responsible investing, ESG investing, impact investing.”

It’s easy to ask, ‘What is ESG?’ or ‘What is Sustainability?’ But, the answer is trickier to pin down.

If it was an easy answer, there wouldn’t be an anti-ESG movement. Greenwashing wouldn’t be a severe worry. And the social science of climate change wouldn’t be our biggest challenge.

The terms exist to challenge established systems because climate change knows no boundaries. Pollution has no borders. And it’s certainly no laughing matter. These are big concepts that often come with despair and frustration.

But, there’s buoyancy in the rough waters.

Some much-needed climate optimism

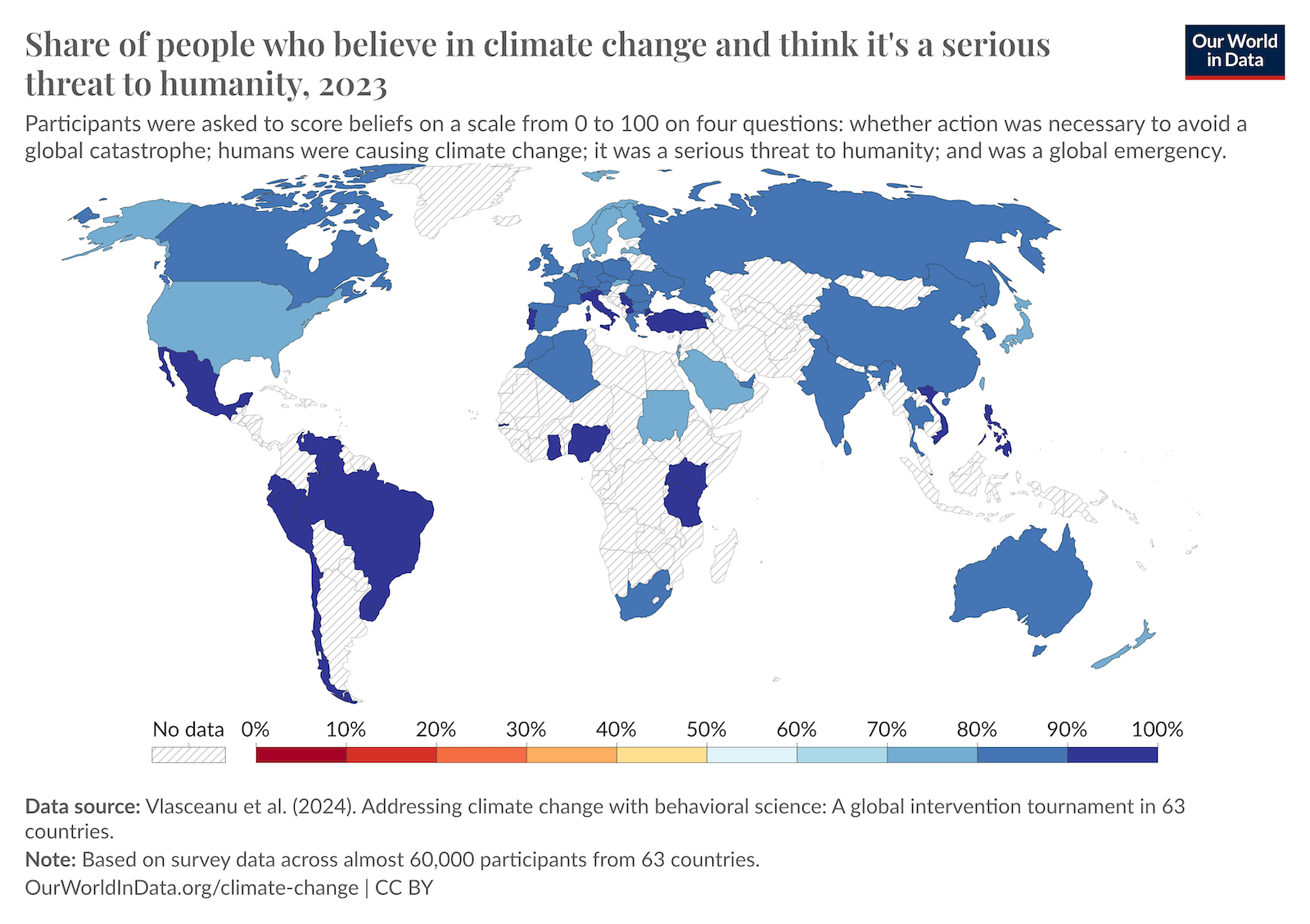

Our World in Data reassures in a recently published piece by Hannah Ritchie that folks everywhere “worry about climate change and support policies to tackle it.” This data is grounded in a recent paper published in Science Advances where Madalina Vlasceanu and colleagues surveyed 59,000 people across 63 countries.

Hannah may be on to something here. The public and the political map indeed underestimate the degree of advocacy for climate action. Perhaps then sustainability is too encompassing because we still think we have to convince folks that climate change is real.

Sustainable-minded businesses concerned about climate change and global society need to focus more on solutions and less on the so-called ‘wicked problems.’ Because the majority of folks are already convinced and concerned and want to see action.

Leave a Reply