As the world grapples with climate change and inequality, brands and businesses are under the microscope to contribute to a more sustainable and equitable future. It’s never been more important to engage in causes that resonate with folk.

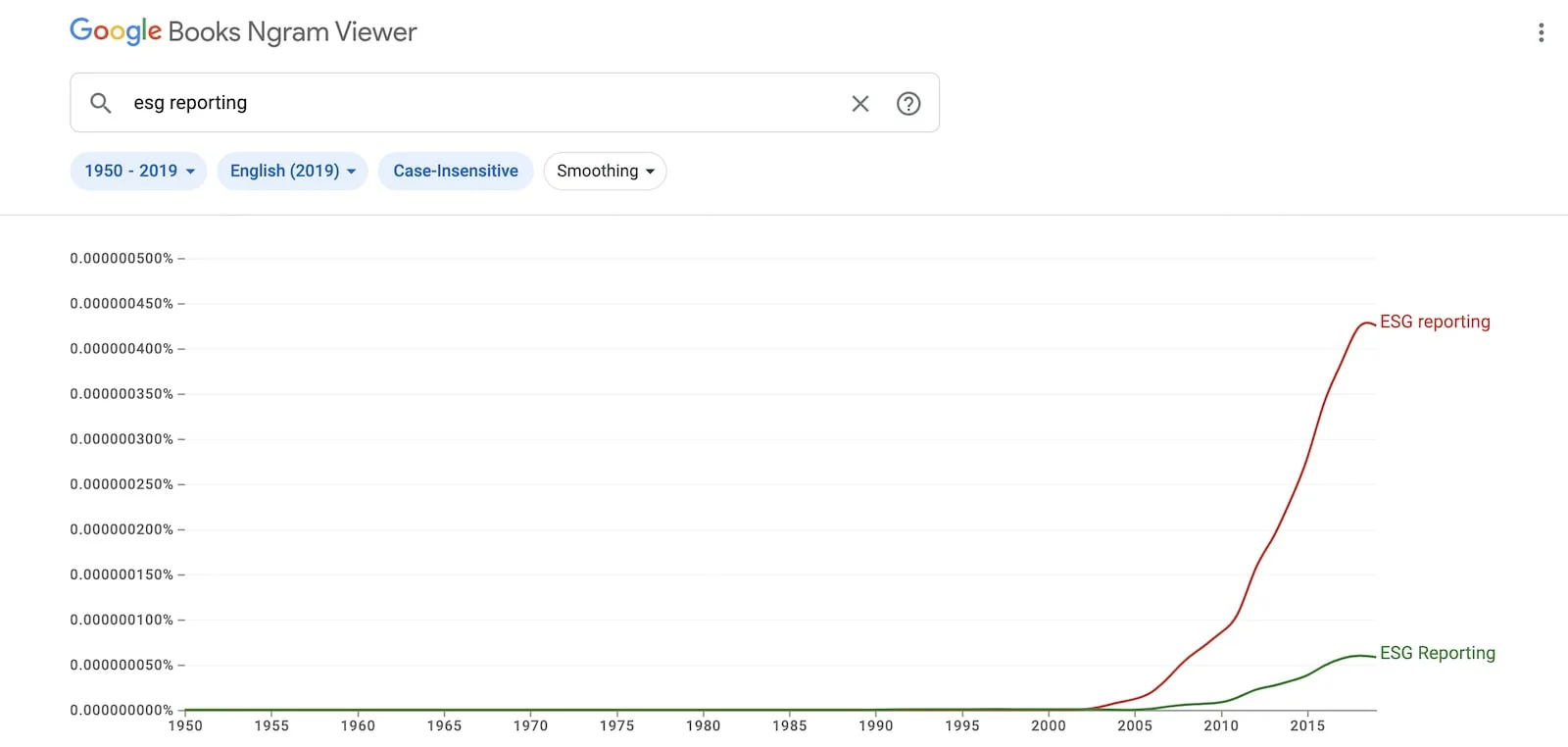

Environmental, social, and governance form the trifecta of the guiding ESG framework, empowering businesses to tackle diverse challenges and generate value that transcends mere profitability, benefiting all stakeholders. While it feels like ESG’s become the norm recently, its roots go a few decades back.

In this exploration of the history of ESG, we delve into its origins and the pivotal role it plays in shaping responsible business practices.

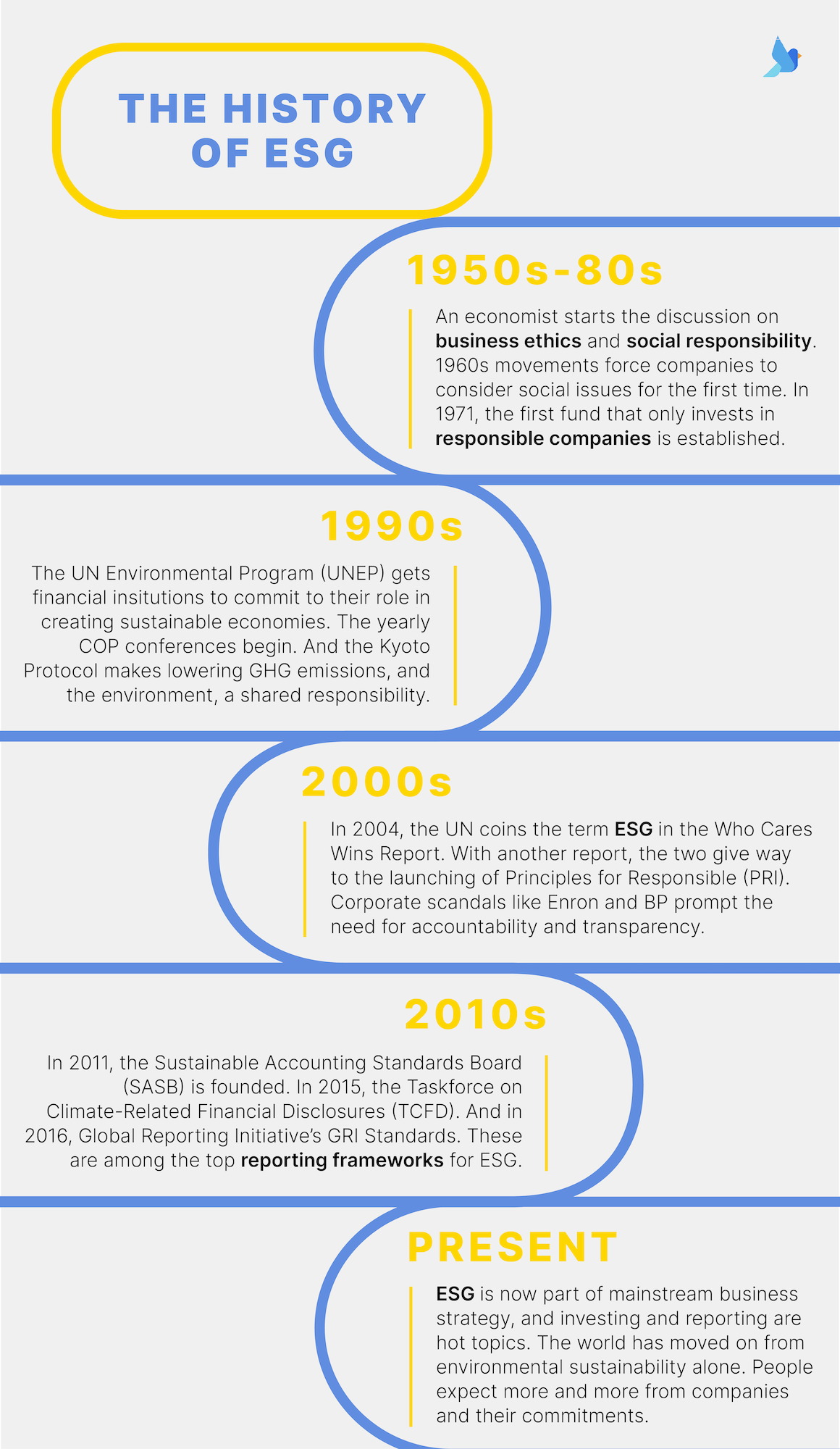

Read on to see how ESG has evolved, or skip to a period of your choice:

1950s to 1970s: Realizing one’s responsibility

Back in 1953, Howard Bowen’s book “Social Responsibilities of the Businessman” started the discussion of corporate accountability. But it went against the rise of institutional investors and the prevailing theory that a company’s most important duty was the satisfaction of its shareholders. To put it plainly, making them loads of money.

In the 1960s, politics became a playground for ESG-like actions. Activists boycotted those supporting the Vietnam War, urging large funds like university endowments to cut ties. The decade, marked by movements like black power and women’s rights, compelled companies and investors to start paying closer attention to social issues.

In 1970, US Senator Gaylord Nelson mobilized nearly 10% of the country for the world’s first Earth Day, pushing eco-conservation into the spotlight. Why? Because of the increasing public concern over pollution, environmental degradation, and health issues caused by industrial activities. Until then, no legal mechanisms were in place to protect the environment. It was perfectly acceptable for a factory to dump toxic waste into a nearby waterway.

In 1971, two United Methodist ministers, who opposed the Vietnam War, boldly created the Pax World Funds (now Impax Funds managed by Impax Asset Management). It was the first publicly available mutual fund in the US that considered social and environmental factors in investment decisions, laying the groundwork for the future of ESG investing.

1980s to 1990s: the UN and COP’s arrival

Throughout the 1980s, the World Bank got more involved in shaping economic and social strategies of the Third World. Every country was after growth, but looming environmental issues like pollution and ozone depletion were unavoidable.

In 1983, the United Nations established an autonomous body to investigate the connection between human activity and the environment, and what they meant for economic and environmental policy. This organization was the Bruntland Commission, formerly the World Commission on Environment and Development. It was their 1987 report that catapulted the concept of sustainable development to the forefront of global discourse.

In 1992, the United Nations Environment Program (UNEP) published the Statement of Commitment by Financial Institutions on Sustainable Development. It was an open acknowledgement by financial institutions of their role in fostering a sustainable economy and lifestyle. Later that year, at the Rio Earth Summit, 154 countries signed the landmark United Nations Framework Convention on Climate Change (UNFCCC). Yes, it’s a lengthy acronym, but you’re probably familiar with its shorter alias, COP.

Building on the momentum of Rio, was the 1997 Kyoto Protocol. Curbing greenhouse gas emissions became a collective responsibility, reinforcing the integration of environmental considerations into a broader ESG strategy.

2000s: Shifting dynamics

The 2000s saw a wave of scandals that prompted the demand for better business practices. Who can forget the fall of Enron?

In 2004, former UN Secretary-General Kofi Annan wrote to over 50 CEOs, urging them to join an initiative under the UN Global Compact.

A year later, the same initiative released the Who Cares Wins Report. It established a crucial link between ESG actions and financial performance. It also was the first time the term ‘ESG’ came into being. That same year, the UNEP Finance Initiative (UNEP/fi) highlighted the relevance of ESG issues in financial valuation in the Freshfields Report.

The two publications laid the foundations for the 2006 launch of the Principles for Responsible Investment (PRI). This organization was to understand the investment implications of ESG factors and promote sustainable investments that accounted for these issues. At the time, 63 investment companies with $6.5 trillion in assets under management (AUM) joined. Each understood the management of environmental, social, and governance issues as integral to companies’ competitiveness in a globalized world.

Another test for huge corporations came in 2010. The BP oil spill was the largest disaster in the petroleum industry’s history. It was a tragedy that ignited a reevaluation of corporate accountability. Affected communities wanted answers, but there were no metrics to say BP was operating against set ethical standards.

2010s: Formalization of ESG

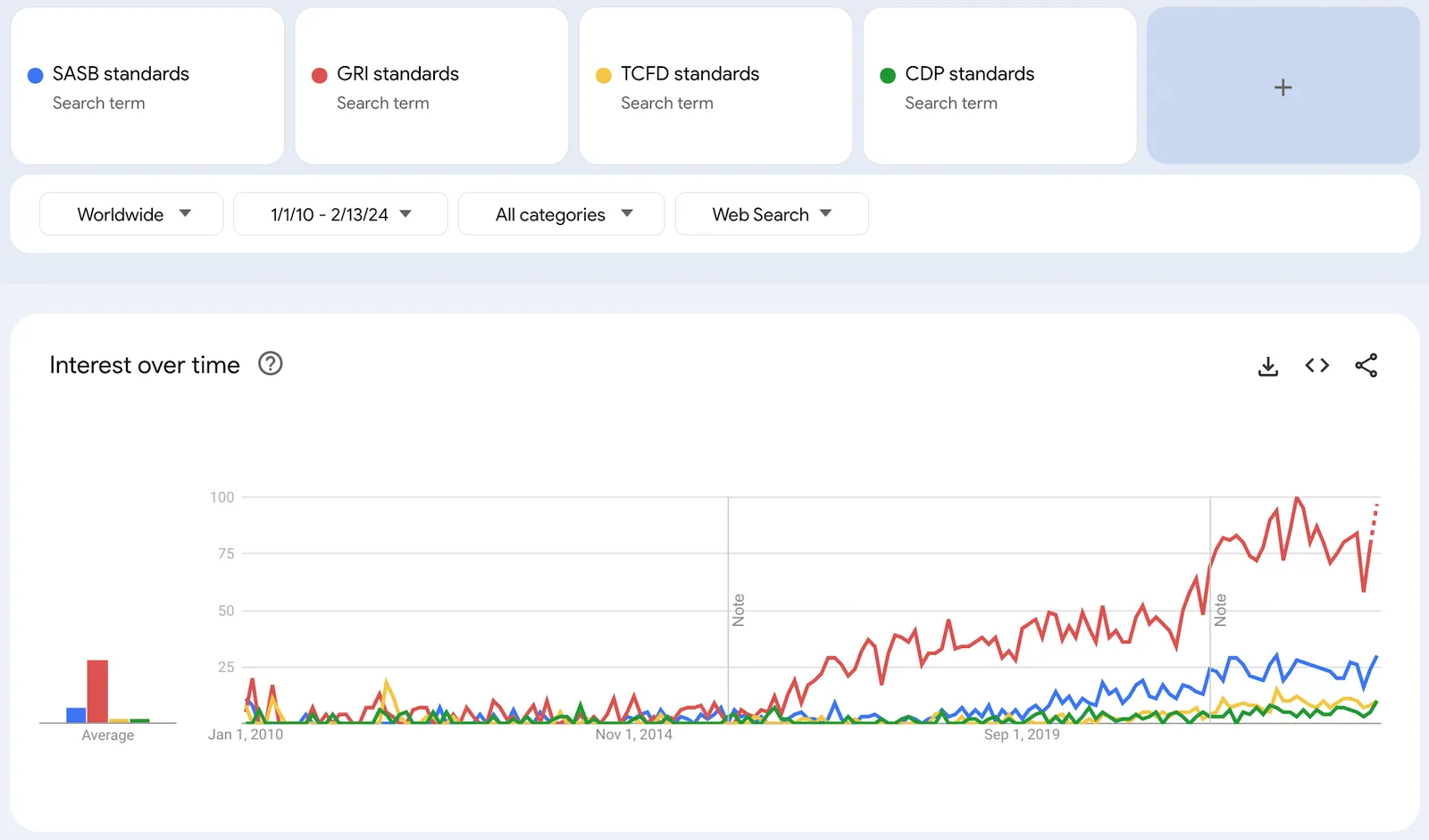

In 2011, Jean Rogers founded the Sustainability Accounting Standards Board (SASB) to develop accounting rules that could reflect ESG’s impact on a company’s bottom line in a specific industry. So beverage companies, for example, would have to account for water security. Energy firms need to consider the environmental impact of their manufacturing equipment. It was about identifying the risks and opportunities associated with sustainability targets, and the start of standardized reporting.

Head to 2015, ESG was very much in the limelight. The UN introduced the 17 Sustainable Development Goals (SDGs). The Financial Stability Board (FSB) established the Taskforce on Climate-related Financial Disclosures (TCFD), offering reporting guidelines for climate-related disclosures. And the world watched as countries agreed to the Paris Agreement. How close we are – we’d say we’re still pretty far – to achieving those goals is another debate for another day.

Though the Global Reporting Initiative (GRI) was set up in 1997, the GRI Standards were introduced in 2016, adding to the formalization of ESG reporting.

At the World Economic Forum 2017 summit in Davos, over 140 CEOs signed The Compact for Responsive and Responsible Leadership. They committed to aligning their goals with the UN’s SDGs, recognizing that serving society’s long-term goals benefits both companies and beyond. By 2019, nearly 200 CEOs gave their pledges to the Business Roundtable’s statement on the purpose of a corporation.

Such public declarations from executives signaled a shift towards leading companies for the benefit of all stakeholders. No longer just the shareholders.

A far cry from the corporate attitude of 50 years before.

Present: ESG is Mainstream

Today, ESG isn’t just a buzzword. It’s determining investment decisions, shaping business strategies, and influencing the global economy. It’s a mirror of the shared values between companies, their customers and communities. Many are embracing a holistic view of ESG, going past environmental sustainability alone.

The last pandemic, for one, brought worker rights to the forefront. Organizations faced demands to take responsibility for employee health, happiness, and job security.

Total transparency is also a cornerstone of ESG strategies, with companies expected to communicate their processes and set clear objectives. So various frameworks, including GRI, CDP, SASB, and TCFD, have emerged as the key players here.

Yet, with the rise of ESG’s prominence, so has the scrutiny. Many are making larger promises, especially concerning climate change mitigation and net-zero targets. The pressure is on all businesses, not only to adopt ESG, but to make meaningful strides in the right direction.

The history of ESG: timeline

Here’s a visual overview of the history of ESG.

Where to next?

In tracing the history of ESG, we’ve seen it evolve from its roots in political movements into a do-or-die in the business world. But with its rise, we can’t forget the shadow of greenwashing, where companies may exploit ESG for mere optics rather than genuine commitment.

Looking forward, its importance is set to grow further. With people expecting more, regulations tightening (just look at the EU), and businesses stepping up to address global challenges, ESG isn’t a passing trend. It’s a force reshaping how businesses navigate the world’s complexities.

If you’re looking to learn more about ESG, try out this post on ESG vs CSR.

Leave a Reply